Payroll services in the digital age

Payroll services in the digital age

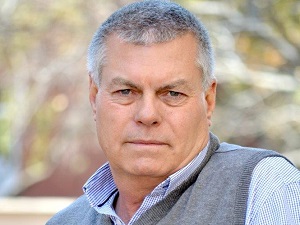

The digital transformation of payroll services has changed the way companies approach this integral back-office function. According to Ian McAlister, General Manager of CRS Technologies South Africa, specialised compensation and remuneration services can help with this transition.

Already, the automation of manual-intensive processes in payroll departments has resulted in staff being refocused on delivering more strategic value to an organisation.

"By taking away much of the admin-intensive functions, automation is giving people more time to review the data at their disposal and develop solutions for customers accordingly. When it comes to payroll, this value can be derived by empowering staff to develop more skills for a digital-friendly environment," he says.

In certain respects, this more process-centric way of approaching payroll has resulted in a variety of apps and self-service tools emerge empowering organisations to do more with the technology at their disposal.

"Additionally, companies need to find increasingly innovate ways to structure compensation packages. Incentives will be driven by outcomes-based performance instead of the traditional fixed structure of either a 13th cheque, share options, and the like."

But automation and compensation packages are just two components of a new digitally led payroll environment.

Part of the new digitalisation of payroll entails outsourcing non-core activities (think payroll administration) to specialists as a way of further improving efficiencies and reducing operating expenses. Furthermore, using the right provider, these outsourced solutions still leave the business in a position to manage and plan payroll costs, secure employee benefits, and avoid spending money on purchasing new payroll technology (this is especially relevant to cloud-based solutions that are continually updated).

"Typically, an outsourced service provider should be able to process wages and salary payrolls weekly, fortnightly or monthly. Part of this entails processing confidential and electronic payslips as well as making electronic payments to PAYE (Pay As You Earn), UIF (Unemployment Insurance Fund), and SDL (Skills Development Levy)."

Such a trusted partner would be able to manage any submissions to SARS and assist with package restructurings and any other statutory registrations.

"We live in a time where specialised payroll consultants can add immense value to any business. Their understanding (and likely innovation) of how technology is impacting these processes can fundamentally change how a business approaches this mission-critical function," McAlister concludes.

Please feel free to contact us or visit our website for more information on taking your payroll into the digital future.