MTN-Ecobank ATM deal highlights mobile money evolution

MTN-Ecobank ATM deal highlights mobile money evolution

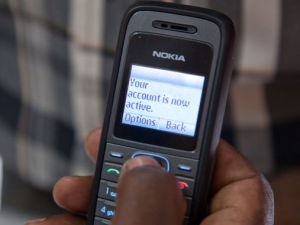

Mobile money in Africa is increasingly also becoming a cardless banking service, says an analyst referring to a deal struck between network MTN and banking conglomerate Ecobank.

MTN has announced it has partnered with Ecobank to allow users of the MTN mobile money service to withdraw cash from the bank’s ATMs.

Twelve countries are to benefit from the deal: Benin, Cameroon, Ivory Coast, Ghana, Guinea Bissau, the Republic of Guinea, Liberia, Congo Brazzaville, Rwanda, South Sudan, Uganda and Zambia.

The MTN deal comes as mobile operators and banks are increasingly working together to get the ‘unbanked’ banked.

Earlier this year, Zimbabwe’s second largest mobile operator Telecel partnered with AfrAsia Bank to launch a mobile money transfer called Telecash.

Telecash has also been integrated on the Zimswitch platform, which operationally interlinks all banks in Zimbabwe.

“It is a trend but it is also compulsory for the service,” said Mbongue, touching on how banks and telecom companies need each for the likes of mobile money ATM withdrawals.

"What this partnership means is that where there is an Ecobank ATM, users will be able to find a ‘cardless’ option that will enable them to enter details received on their mobile phone and withdraw cash freely," explained Mbongue regarding the Ecobank-MTN deal.

Mbongue further explained that apart from Kenya's Safaricom -- where that operator's mobile money service, M-Pesa, is solely driven by the telco for most mobile money services -- banks are increasingly working with telecom players to help drive the solution.

Commenting on the MTN-Ecobank deal in a statement, MTN Group chief commercial officer Pieter Verkade said, "We are extending our co-operation in Africa to expand the range of services provided, as well as to further explore the development of mobile financial services in these countries."

The statement also revealed that MTN and Ecobank are looking to partner in developing a unique mobile savings offering within their countries of mutual presence.