Data restriction impacting on Africa's smartphone growth

Data restriction impacting on Africa's smartphone growth

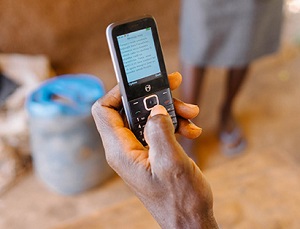

The increasing cost of data in several regions in Africa has priced out many consumers and one of the main reasons for the continued popularity of the less data-heavy feature phones.

This is according to Koffi Kouakou, scenario strategist and senior lecturer at the Wits School of Governance, University of the Witwatersrand in Johannesburg.

Kouakou is not surprised by the findings of recent IDC research into smartphone sales in Africa, specifically that it reflects a slowdown in the continent's smartphone revolution and the resilience of feature phones.

According to the IDC, the continent's smartphone market totalled 95.37 million units in 2016 and while this is up 3.4% year-on-year "it represents a considerable deceleration from the double-digit growth rates seen in the previous two years, with demand being hampered by the currency fluctuations that are affecting the continent."

The research firm released a statement saying that overall, 215.33 million mobile handsets were shipped in Africa during 2016, up 10.1% on the previous year. "However, it was feature phones that were largely responsible for this growth, with shipments increasing 16.1% year-on-year in 2016 to total 119.97 million units."

This growth saw feature phones increase their unit share of Africa's overall handset market from 53% in 2015 to 56% in 2016, according to the IDC.

"Having a cell phone, not just a cellphone but a smartphone, is better than having cash... it is lifeline. You could spend the R1000 or the money, but with a cellphone, you have a lifeline with family," says Kouakou. "In terms of usability, (feature phones) are very simple to use and they don't consume a lot of data. We are actually talking about a 'data dompas', which means you are very restricted in terms of data access, because it is so costly. Another key trend is that people own more than one phone, a feature one and a smartphone."

Reflecting on the status of Africa's smartphone market, Kouakou says that Chinese firms will continue to do well on the continent because they have broken down all the costs and retain the same value proposition for consumers compared to some of their 'western' counterparts.

He also says currency fluctuation should be discussed in more detail, with specific examples, because this is not a new phenomenon within the Africa market.

"There is a lot of smuggling as well," says Kouakou, adding that Africa has both an official and unofficial mobile phone market, and this has a bearing on the tracking and measurement of sales.

Arthur Goldstuck, MD of World Wide Worx, says in South Africa there is a massive migration to smartphones, although feature phones remain strong.

"However, because of the prevalence of local brands, and their distribution through informal channels, much of the smartphone market goes unmeasured. This is even more pronounced in the rest of Africa, where operators are not the main movers of handsets."

Goldstuck adds that one of the key strategies being adopted by no-name vendors is to remove as many costs as possible from the equation, including brand, marketing and licensing costs. This means bare-bones handsets are flooding the market, almost undetected.

Name-brand vendors are focusing on Wide ranges of product, from entry-level to high end, in order to capture every level of affordability. At the entry-level, this often means subsidies to capture the market in the hope of long-term loyalty.